Dubai’s real estate market continues to attract global investors with its high rental yields, tax-free benefits, and world-class infrastructure. Whether you’re a first-time buyer, an expat investor, or a seasoned property mogul, success in this competitive market starts with knowledge.

One of the most effective ways to gain expertise is by reading Books On Real Estate Investing. These books provide proven strategies, case studies, and market insights that can help you make informed decisions in Dubai’s dynamic property landscape.

In this comprehensive guide, we’ll explore:

✅ The best books for beginners and advanced investors

✅ How to apply these strategies in Dubai’s market

✅ Key legal and financial considerations

✅ FAQs for new investors

Why Every Investor in Dubai Should Read Real Estate Books

1. Understand Market Cycles & Trends

Dubai’s real estate market experiences fluctuations due to economic factors, government policies, and global demand. Books like “Mastering the Real Estate Market” teach how to identify cycles and invest at the right time.

2. Learn Financing Strategies

From mortgages to off-plan payment plans, financing a property in Dubai requires smart planning. Books such as “The Real Estate Game“ break down financing options, loan structures, and risk management.

3. Avoid Costly Mistakes

Many first-time investors lose money by skipping due diligence. Books like “What Every Real Estate Investor Needs to Know About Cash Flow” highlight common pitfalls and how to avoid them.

4. Dubai-Specific Regulations

Understanding RERA laws, freehold vs. leasehold rules, and tenant rights is crucial. Local guides and international books with case studies on global markets (including Dubai) provide valuable insights.

Top 7 Must-Read Books On Real Estate Investing

1. Rich Dad Poor Dad – Robert Kiyosaki

Best for: Shifting your money mindset

Why Dubai investors should read it: Teaches the importance of assets (like real estate) over liabilities, crucial for building wealth in Dubai’s high-growth market.

2. The Millionaire Real Estate Investor – Gary Keller

Best for: Building a long-term strategy

Key takeaway for Dubai: Case studies from successful investors help you analyze deals like a pro—essential in Dubai’s competitive market.

3. "The Book on Rental Property Investing" – Brandon Turner

Best for: Buy-to-let investors

Why it’s perfect for Dubai: With high rental demand in areas like Dubai Marina and Downtown, this book teaches cash flow analysis and tenant management.

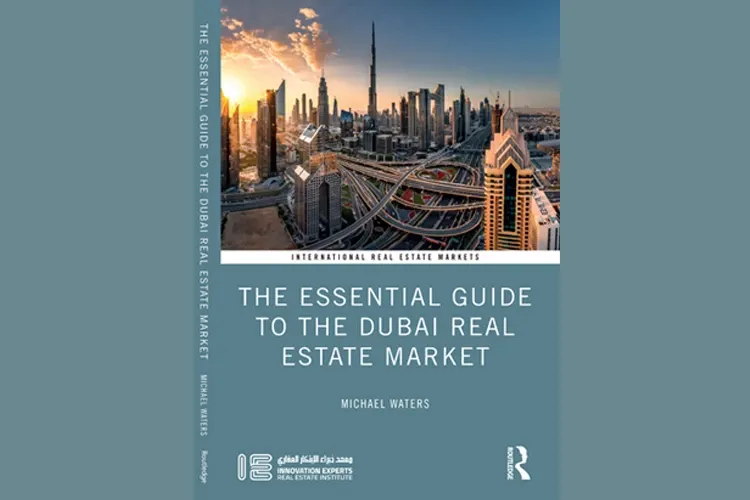

4. Dubai Real Estate Market Handbook (Local Guide)

Best for: Understanding Dubai’s unique market

Key topics:

✔ Freehold vs. leasehold areas

✔ RERA regulations & tenant laws

✔ Off-plan vs. secondary market pros/cons

5. "The ABCs of Real Estate Investing" – Ken McElroy

Best for: Scaling your portfolio

Dubai application: Learn how to evaluate large-scale investments, such as commercial properties or villa communities in Dubai.

6. "The Real Estate Game" – William J. Poorvu

Best for: Risk management & deal structuring

Why it’s useful in Dubai: Covers negotiation tactics, financing, and exit strategies—key for off-plan and resale investments.

7. "Buy, Rehab, Rent, Refinance, Repeat" – David Greene

Best for: Fix-and-flip investors

Dubai relevance: While flipping is less common in Dubai, this book teaches value-add strategies for maximizing ROI.

Read More: How to Buy Real Estate in Dubai Like a Pro

How to Apply These Lessons in Dubai’s Market

1. Financing Your Investment

- Mortgages: Expats can secure loans up to 75% of property value.

- Off-Plan Benefits: Developers like Emaar and Nakheel offer flexible payment plans (e.g., 5% down, 80/20 payment schemes).

- Rental Yields: Areas like International City (8-10% ROI) and Dubai Silicon Oasis (6-7% ROI) offer strong returns.

2. Legal Considerations

- RERA Regulations: Ensures transparency in contracts and dispute resolution.

- Freehold Areas: Expats can buy in zones like Palm Jumeirah, Downtown, and Dubai Marina.

- Tax Benefits: No property tax, no capital gains tax (under certain conditions).

3. Market Trends (2024-2025)

- Expo City & Dubai South: Emerging hotspots with growth potential.

- Short-Term Rentals: Airbnb-style rentals are booming in tourist-heavy areas.

- Sustainability Focus: Green buildings (like Dubai Creek Harbour) are gaining demand.

FAQs: Books On Real Estate Investing in Dubai

1. Which Books On Real Estate Investing is best for beginners?

“Rich Dad Poor Dad” (mindset) + “The Millionaire Real Estate Investor” (practical steps).

2. Are there books specifically about Dubai’s market?

Yes, look for “Dubai Real Estate Market Handbook” or reports from RERA and DLD.

3. How do I analyze a property’s ROI in Dubai?

Books like “The Book on Rental Property Investing” teach cash flow calculations. Key metrics:

✔ Rental yield (%)

✔ Capital appreciation potential

✔ Service charges & maintenance costs

4. Can I invest in Dubai real estate with little capital?

Yes! Off-plan properties allow low down payments (as little as 5%). Books like “The Real Estate Game” cover creative financing.

5. Where can I buy these books in Dubai?

- Amazon.ae (for physical & Kindle versions)

- Kinokuniya (Dubai Mall & MOE)

- RERA’s official publications (for Dubai-specific guides)

Final Thoughts

Investing in Dubai real estate can be highly profitable—if you have the right knowledge. Books On Real Estate Investing provide the foundation, strategies, and confidence needed to succeed. Start with one or two books, apply the lessons, and consult experts (like 971 Realty) to navigate the market safely.